Day ahead Market

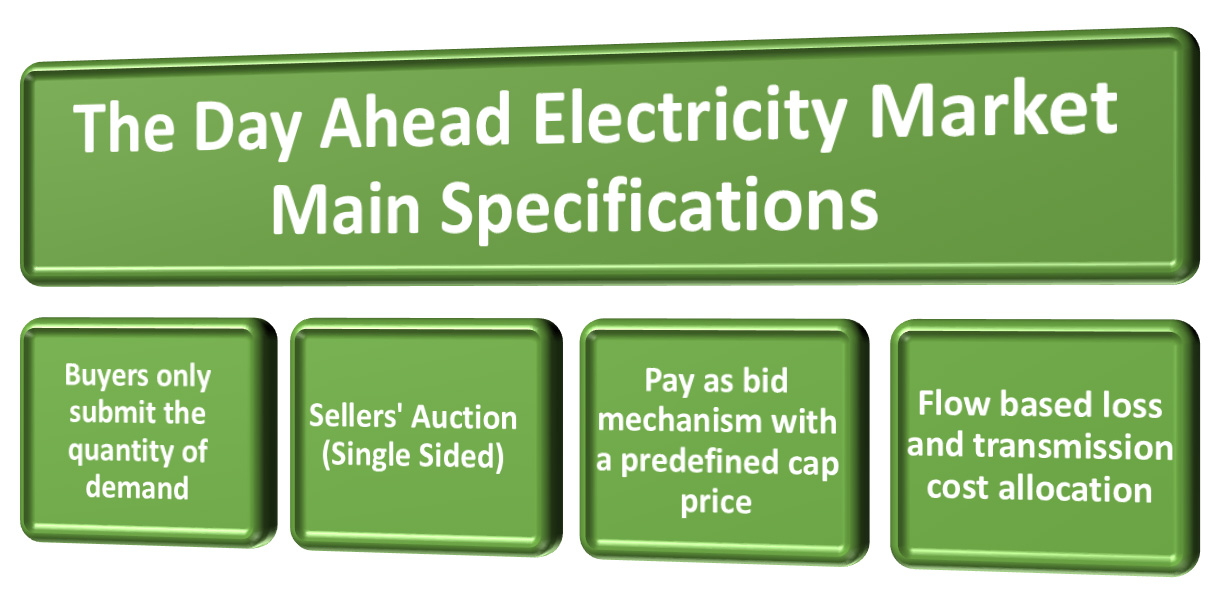

In the day ahead market an auction is taken place for the sellers using pay as bid clearing mechanism. Sellers submit their bids a day before the delivery of power. The sellers' bids consist of the prices and the quantities. The customers only submit their quantity of demand. As a matter of fact, this mechanism is a single sided auction for the sellers. Market operator clears the market based on the submitted bids of the sellers and the buyers' demand. A sophisticated optimization problem is solved minimizing the cost of electricity subjected to a suite of constraints. Transmission & generation system associated constraints are considered in the optimization problem resulting a well-tuned technical/economic generation schedule for the power plants. A price cap is determined by the IERB limiting the sellers' maximum bidding price.

In IREMA, sellers should submit their bid before 10AM in the day prior to the delivery of power. The system operator officially announced the scheduled outages data to the market operator until 14:00. This schedule determines the power plants should be omitted to allocate power for the next day. Fuel availability data is also announced at 14.00. Market operator derives the unit commitment schedule. The Security Constrained Unit Commitment (SCUC) is solved to determine the market settlement results. Then, settled market output are announced and the market players access to the results. The results should be uploaded until 21:00. The timing of the day-ahead market is illustrated in the subsequent figure.